- Client: Vlaamse Energieagentschap (VEA)

- Implementation period: December, 2019 - February, 2020 (Completed)

- Geographic coverage: Belgium

- Theme: Energy

- Topic:

- Experts: Onne Hoogland, Luc van Nuffel

What is an appropriate rate of return for renewable energy investors?

The Flemish government stimulates investments in sustainable energy generation (renewables and CHP) through portfolio standards and certificates. For estimating the number of certificates for each technology an assumption on the minimum required internal rate of return (IRR) is needed. In this study, we evaluated if the IRR-based method is sound, what an appropriate level of return would be under the current market circumstances, and what the impact of a potential further capping of the maximum support level would be.

This investigation provided the following preliminary results:

The key findings of the project are:

- The IRR-based methodology is sound;

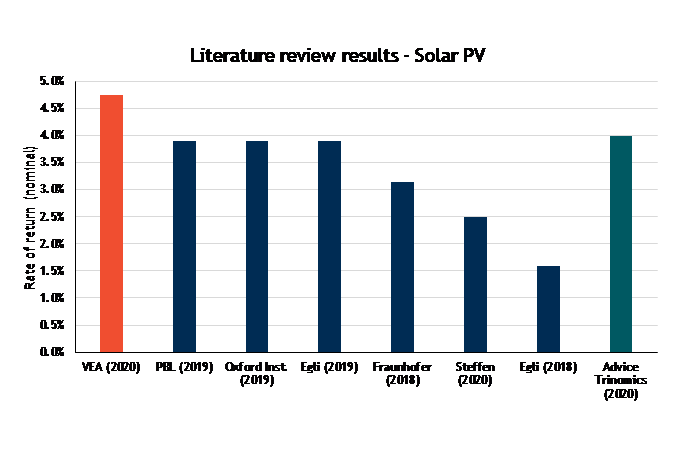

- The IRR values are higher than current market figures. A downward revision to 4% (solar PV), 4.5% (onshore wind) and 7.5% (bio-energy and CHP) is advised;

- The impact of further capping the maximum support levels is limited but the benefits are also limited. In particular for the most cost competitive technologies (solar and wind) we advise against capping the support levels.