- Client: European Commission - DG Environment

- Implementation period: January, 2011 - December, 2012 (Completed)

- Geographic coverage: Global

- Theme: Environment

- Topic:

- Experts: Koen Rademaekers, Katarina Svatikova

What were the past price trends of major resources and how will their prices evolve by 2020?

The study examined real price changes in over 20 resources over the last 50 years and made projections of these prices into the future (by 2020). The project was carried out as part of the resource efficiency initiative of the European Commission, to understand real price movements, their drivers and impacts, and their implications for the competitiveness of the EU economy. The selected resources covered metals, minerals, fuels, food, fish, timber, water, land and biomass. The study was started by Trinomics staff while working at Ecorys and completed at Trinomics.

Key findings:

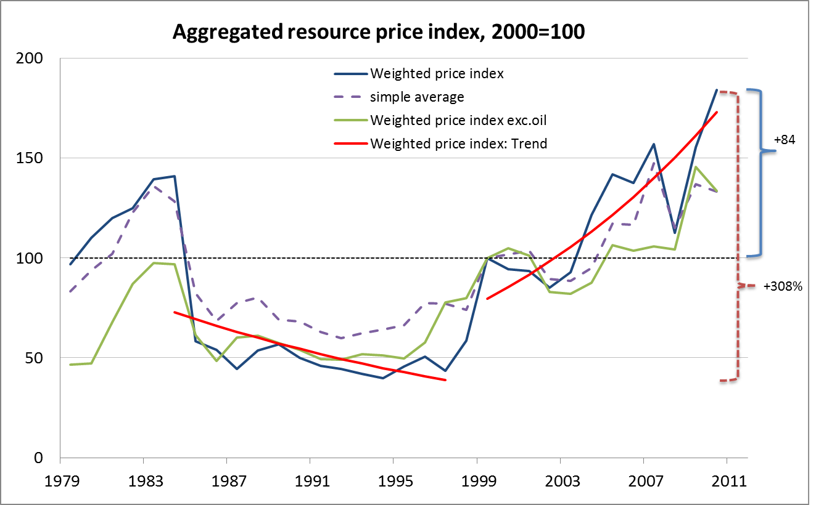

- Historic trends: Resource prices for metals, minerals, fuels, fish, timber and biomass generally decreased until 1998, after which they have been steadily increasing. On average, real prices increased by more than 300% between 1998 and 2011.

- Volatility: On average, resource price volatility has increased in the last 10 years, however, similarly high (or even higher) price volatility has occurred in the past for some resources.

- The key drivers of price changes are supply and demand factors (production capacity, industry demand, recycling and substitutability), market structures (competitive, oligopolistic or local markets), government interventions (export restrictions, subsidies or other trade policies), energy prices and environmental changes (drought, floods, deforestation, climate change).

- Future trends: In general, the prices of commodities are expected to rise due to increased population growth, demand from emerging economies, and potentially from increased political risk in producing countries for critical materials. However, stagnation or even a decrease in prices is expected for some other resources. The price of oil is forecast to increase, but the price of renewable energy is forecast to decrease.

- Competitiveness: Europe is highly dependent on imports of metals, minerals and oil, but a net exporter of wheat, potatoes, sawnwood, and wind energy products and services. Recycling and finding substitutes for critical resources can help Europe to mitigate the supply risk and avoid high prices.