- Client: DG Research & Innovation (RTD) (European Commission)

- Implementation period: January, 2016 - April, 2017 (Completed)

- Geographic coverage: European Union

- Theme: Climate Change, Energy

- Topic: Climate Change Mitigation, Renewable Energy

- Experts: Hans Bolscher, Koen Rademaekers, Onne Hoogland, Jessica Yearwood Travezán

Can the European solar PV industry regain its leading position?

There is a need to better understand how Europe, and especially Germany, has lost their leading position in the PV sector, after decades of investment in this emerging sector. It took more than 20 years to build up the industry, but it took the Chinese companies less than five years to achieve global market dominance. Detailed analysis to the reasons behind this dramatic change allowed to extract lessons on how to rebuild the sector, but also on how to better protect emerging sectors in general.

The first objective of this study was to assess the current situation of the PV sector in Europe and worldwide. This included a thorough analysis of the industrial decline on PV manufacturing. Secondly, this assignment identified options and strategies to rebuild the PV manufacturing industry in Europe, including concrete policy measures for implementing such a strategy. The study has been performed in collaboration with DNV GL, JIIP, PWC, Ricardo Energy & Environment, Tecnalia, and VTT.

Key findings of the study can be summarised as follows:

- While Europe has lost considerable market share, a significant industry remains with an estimated annual turnover of EUR 5 billion. The remaining industry consists for a large part of equipment manufacturers (63% of EU turnover) and inverter manufacturers (20% of EU turnover).

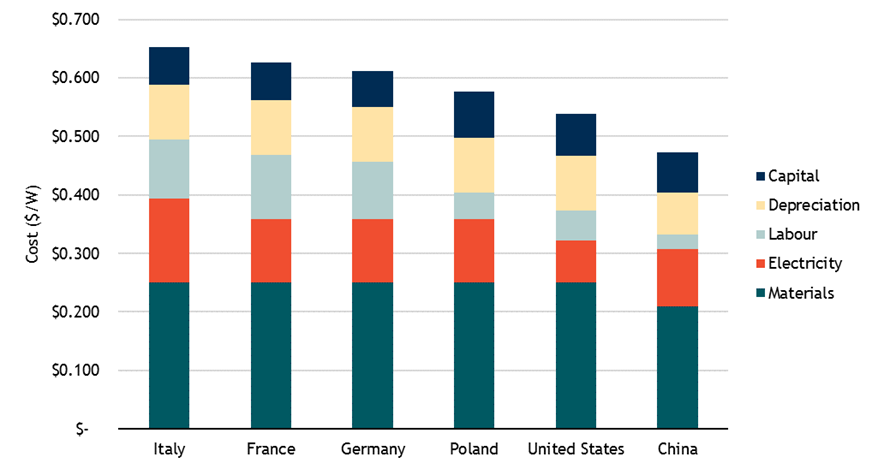

- The framework conditions result in relatively high costs for inputs such as labour, energy, materials and equipment, which is most important for the mass-production of polysilicon, wafers, cells and modules. The more knowledge-intensive equipment and inverter manufacturing industries are less affected by these framework conditions and can benefit from a skilled labour force and strong research infrastructure.

- Promising opportunities for reindustrialisation exist by deploying a strategy focused on tailored PV products, knowledge-intensive parts of the value chain, and the commercialisation of novel technologies. Such a strategy could be implemented by a set of nine policy measures that target demand, supply, RD&I and trade related aspects. These measures appear to be feasible but require a coordinated effort to be successful.

- DG GROW, DG ENER and DG RTD would be best positioned to lead the strategy but would require committed leadership from the industry and the financial sector. A concerted effort to rebuild the industry could be justified as it contributes to EU objectives such as economic growth, leadership in renewable energy technologies and security of supply.